According to Global Impact Investing Network (GIIN) the size of the global impact investing market in 2024 will be more than $1 trillion. The United Nations predicts that more than USD 30 trillion of investment will be required to meet the Sustainable Development Goals by 2030. That’s more than three times the current value of all commercial real estate in the European Union.

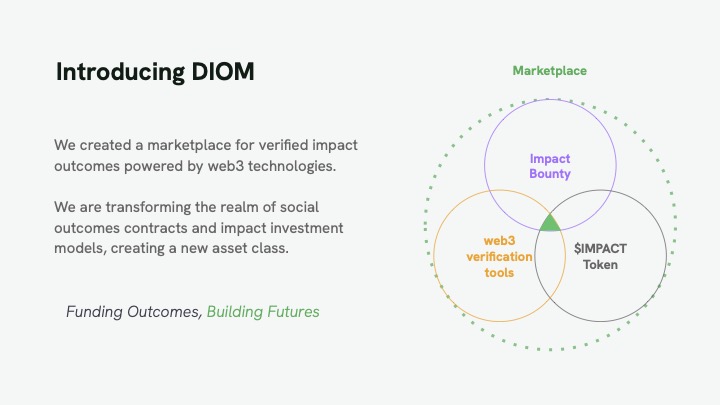

At ImpactScope our thesis is that the next decade will see a paradigm shift in the way impact outcomes are measured, monitored, and monetized. The confluence of Blockchain Technology, web3 primitives, and Artificial Intelligence will spawn new toolkits for verifying social and environmental impact achievements, while combating impact washing. Simultaneously, new financial models will transform impact outcomes into liquid, tradable digital instruments.

“Transitioning social impact into an asset sets the stage for more social-sector business opportunities and financial products to emerge, just as they have in the carbon offset market.”

Phyllis Kurlander Costanza, Co-founder of Outcomes, Harvard Business Review

From accelerating the energy transition to addressing plastic pollution, from reducing crime to improving food security, from protecting biodiversity to increasing access to clean water, all successful social and environmental outcomes hold value. Once consensus is reached on how to calculate that value, innovative financial instruments will emerge which allow for the value of impact outcomes to be captured, fractionalized and ultimately transformed into liquid digital assets. At ImpactScope we are building the onchain infrastructure to enable this.

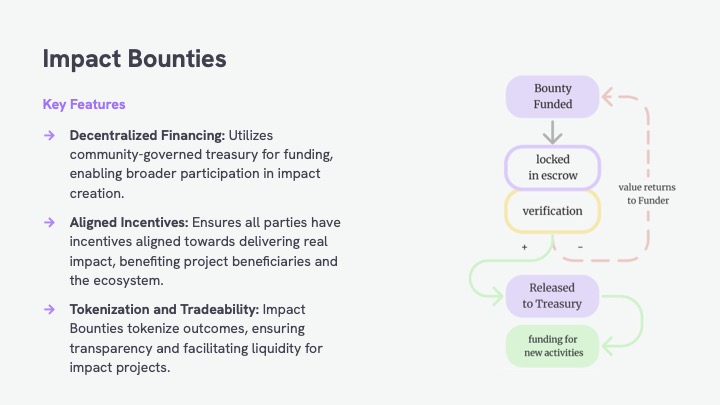

DIOM has three primary stakeholders: Impact Outcome Commissioner, Impact Creators and Impact Stewards. The impact outcome journey begins with what we call the Impact Bounty, which is an escrowed reward for creating a pre-defined outcome. The Impact Outcome Commissioner defines what success looks like and sets the parameters of the Impact Bounty in a smart contract. This can be the construction of 45 new public toilets in a town in northern Uganda, 100 tonnes of ocean plastic collected in southern England, a 30 % reduction in missed school attendance in an inner city suburb. The bounty is released only after the impact outcome has been achieved and verified in accordance with the parameters.

Who are these Impact Outcome Commissioners? Large NGOs, international development foundations, good corporate citizens, philanthropic organisations, all of which are looking for ways to reduce overheads, and generate greater levels of impact. On average NGOs and charities spend 15 % of their annual budgets on fundraising costs and a further 20 % on administration costs. DIOM makes creating impact outcomes more cost effective. At the same time, DIOM helps derisk impact creation by transforming it into a pay-for-results smart contract.

By leveraging the inherent transparency, traceability, and trust guarantees of Blockchain, our infrastructure facilitates accurate, real-time, and transparent Measurement, Reporting, and Verification functions.

When these attributes are applied to the verification and measurement of impact, the results are tools and interfaces which monitor and report on impact metrics in a transparent and continuous fashion. This leads to more credibility and transparency than traditional impact reporting outputs, which are too static, too intermittent, and centrally reported.

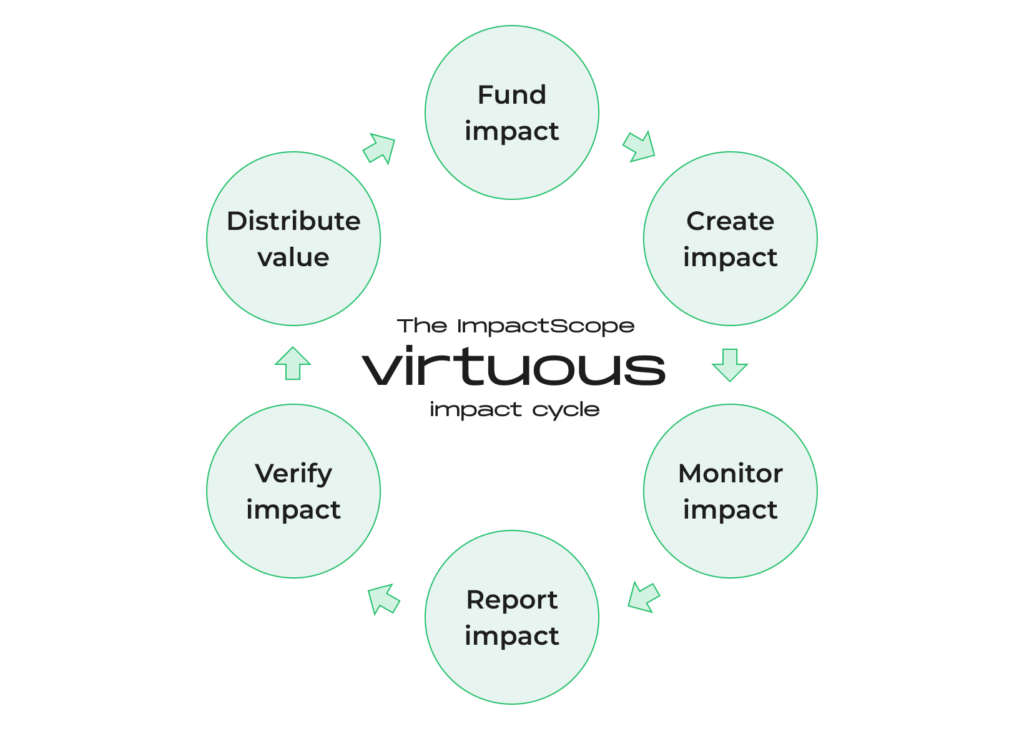

By combining DAO mechanics, tokenomics engineering and decentralized crowdfunding, DIOM aligns the interests of all stakeholders around the goal of delivering tangible verified impact, creating the flywheel that is the Virtuous Impact Cycle, where impact begets value, and value circulates to fuel future impact creation. DAO governance enables Impact Stewards to collectively make decisions, while economic incentives facilitate the creation and maintenance of impact. Decentralized crowdfunding mobilizes capital in an efficient and effective manner, bringing down the time-to-delivery of impact outcomes significantly compared to traditional impact financing models.

If you’d like to learn more about the evolution of DIOM we invite you to read our white paper. To see the advantages of DIOM from the perspective of Impact Outcome Commissioner check out this video. Finally, if you are from an eligible jurisdiction, soon you may be able to pre-purchase DIOM governance tokens on Polimec. Stay tuned!