Case Studies

ImpactScope helps organizations use web3 tools and Artificial Intelligence to verify, measure and amplify their positive impact.

Have a look at the case studies below and discover how your organization can use tools such as Dynamic Proof of Impact NFTs, offchain oracles, Act2Earn tokenomics models and machine learning applications to verify and amplify your sustainability achievements

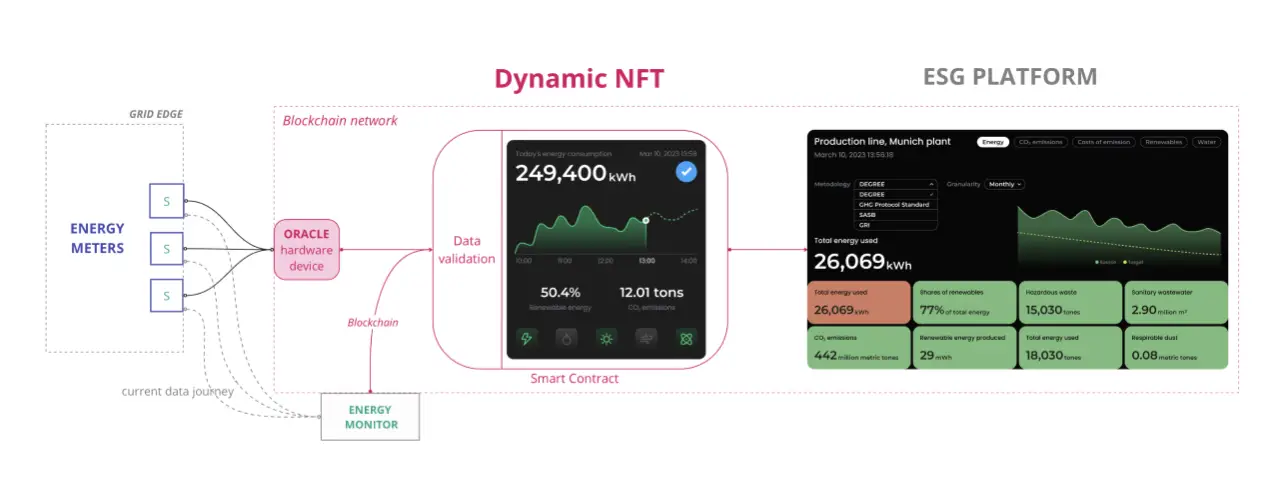

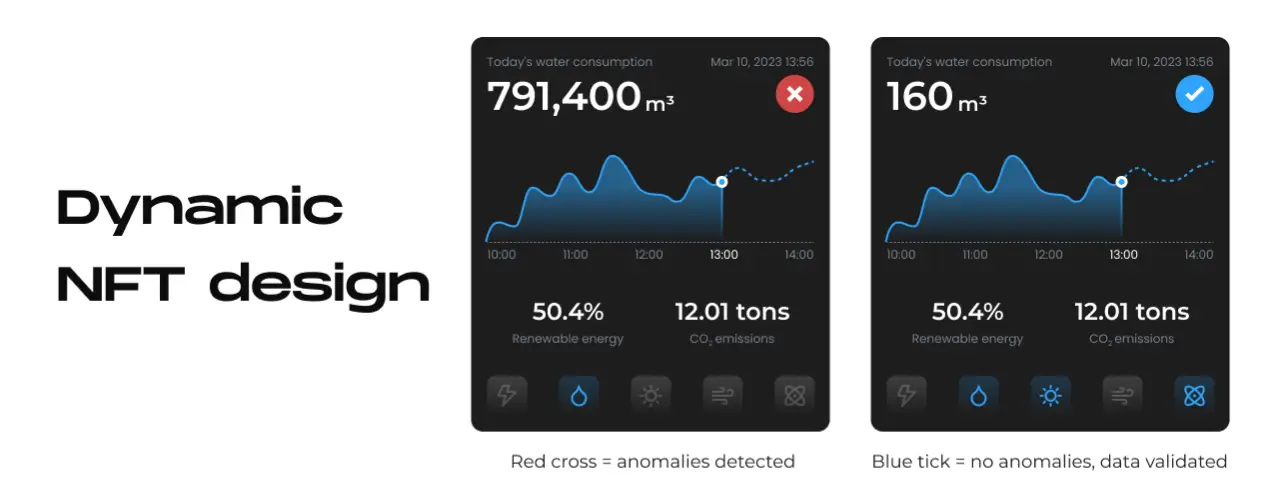

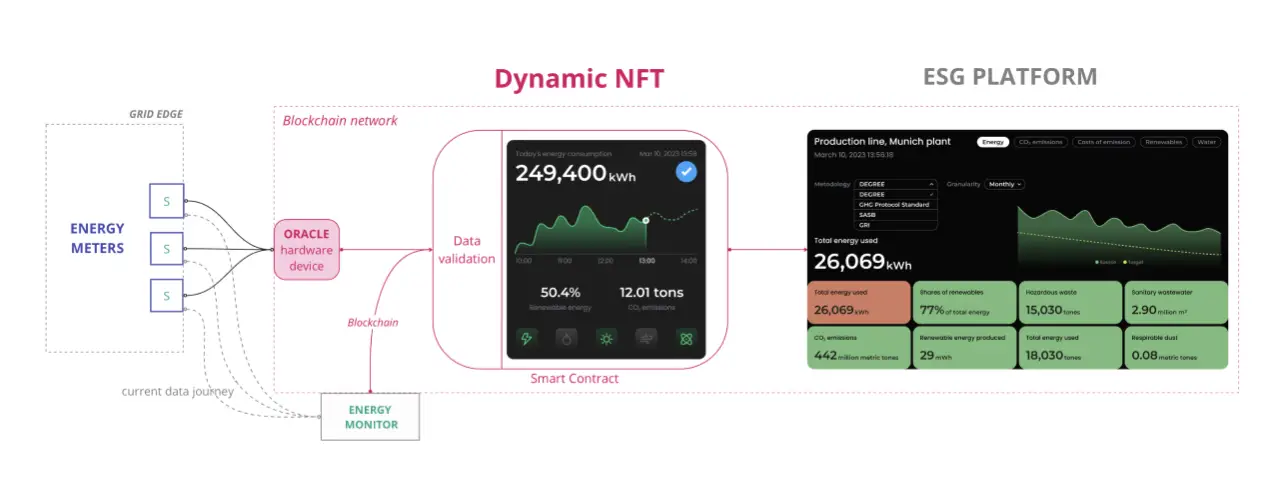

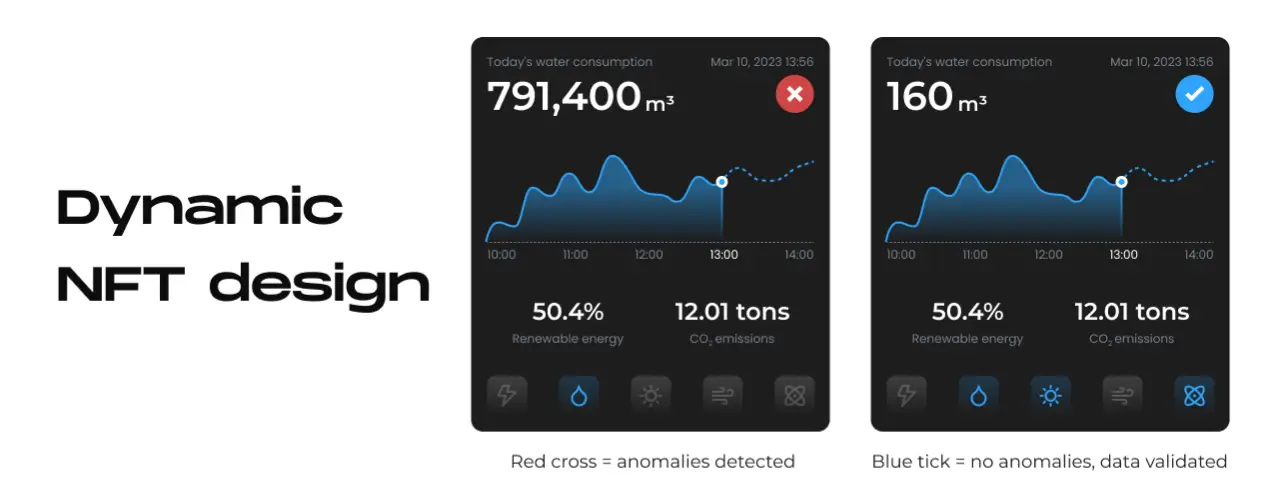

Verifying Data Integrity

Smart contracts meet smart meters: revolutionizing energy data verification with Dynamic NFTs.

ImpactScope was one of three global finalists in the Siemens Tokenize the Energy Transition Challenge. Our task was to develop a web3 solution to help Siemens “represent, monitor and validate sustainable assets”. Our proposal was a web3 application designed to optimize and future-proof ESG reporting for Siemens’ Energy Performance Contracting clients, while helping Siemens reduce its data management costs.

As part of our solution, ImpactScope designed a set of dynamic NFTs, which recorded energy metadata using oracles connected to smart meters. The metadata is then sent on-chain to a platform, which can be configured to display selected metrics according to any number of ESG reporting standards.

Tokenizing Behavior Change

Converting fan loyalty into forest restoration through innovative tokenomics.

Football for Forests hosts the global Forest Restoration League in which fans compete for their clubs to restore the most forest. The Restoration League allows football fans, the football clubs they support, and corporate sponsors to compete in restoring areas of forest.

Football for Forests hired ImpactScope to propose tokenomics mechanisms aimed at increasing user engagement, encouraging additional donations and rewarding super users. Following a series a workshops we designed Learn2Earn token reward models and automated fund-matching processes.

Identifying Greenwashing

in Financial Products

Building trust in green finance through automated authenticity checks

The Global Financial Innovation Network (GFIN) coordinates the work of international financial regulators committed to supporting financial innovation in the interest of consumers. Alongside Ernst & Young, Sony Laboratories and King’s College London, ImpactScope was invited to participate in the first ever GFIN Greenwashing TechSprint, a 3-month digital sandbox programme aimed at developing applications to “tackle or mitigate the risks of greenwashing in financial services.”

ImpactScope’s proposed solution is a deep learning application which compares “green” claims made in corporate ESG reports and product descriptions with statements on social media and references in carbon offset registries. Our algorithms are able to quickly flag potential instances of greenwashing and automatically record them on an private blockchain while simultaneously notifying the appropriate financial regulator.

Analyzing the CO2 emissions of digital asset ventures

Making crypto carbon-conscious: Real-time carbon tracking for the world’s leading crypto companies

US BTC Corp (Hut 8 Mining), Arthur Mining, Next Earth et al

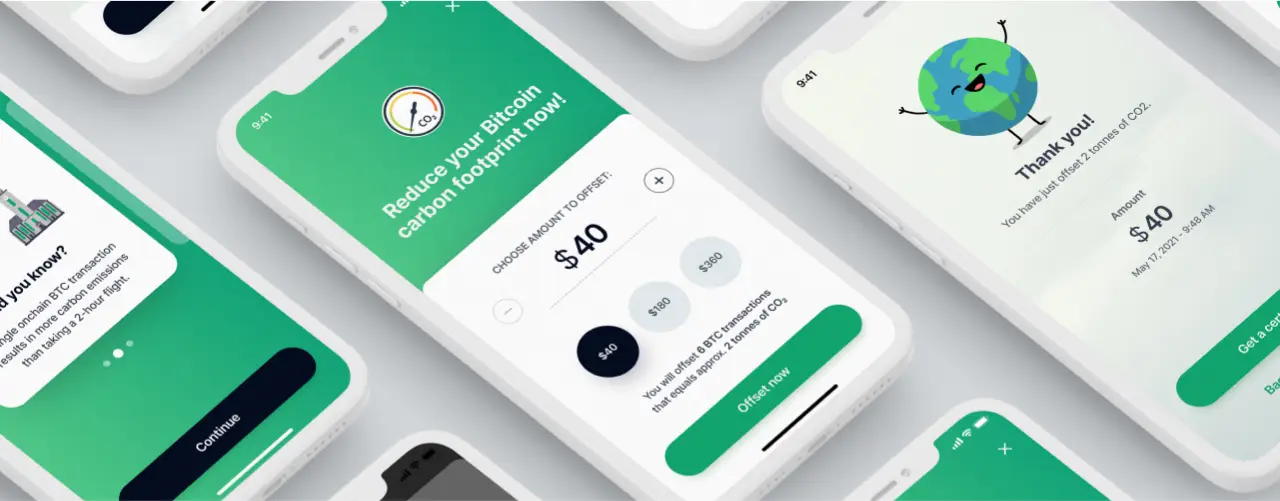

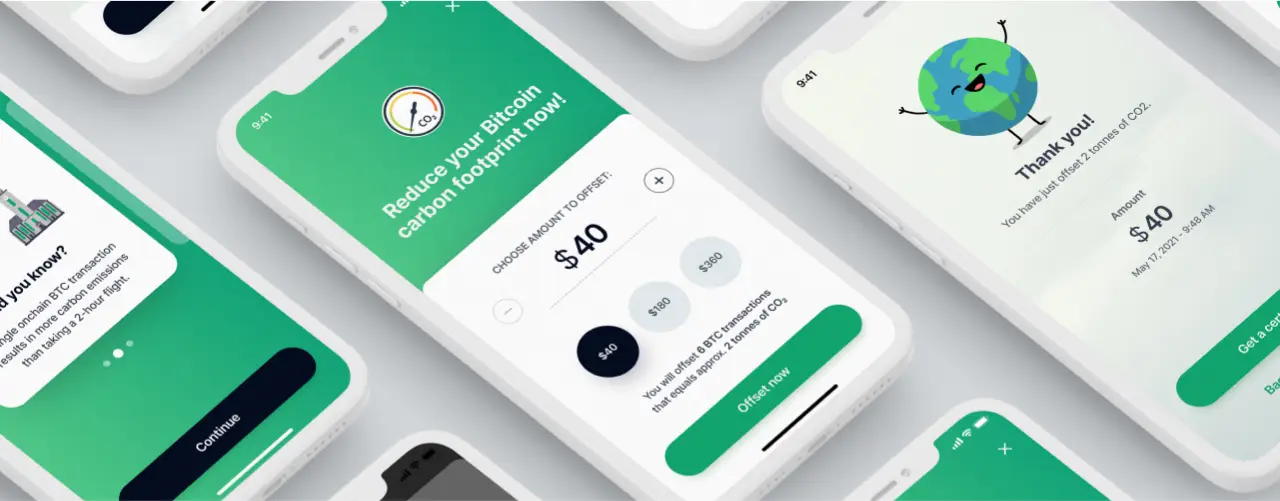

Since Q1 2021, on behalf of our digital asset venture clients, ImpactScope has analyzed the carbon emissions of over 1 million transactions across multiple blockchains. From easy-to-integrate carbon offsetting components for cryptocurrency exchanges to complex carbon audits for publicly traded bitcoin mining firms, ImpactScope’s climate action tools and services are used by the world’s leading crypto companies.

ImpactScope has built multiple precise carbon footprint calculators for public wallet addresses. The onchain tools are free to use and can calculate the historical carbon emissions of any BTC, ETH or MATIC wallet address. With our real-time, easy-to-integrate carbon offsetting APIs for cryptocurrency exchanges, any digital asset marketplace can integrate CO2 compensation tools into their trading systems, allowing their users to measure and offset the carbon emissions of their onchain activity.