Where Impact

Finds a Home

Decentralized Impact

Outcomes Marketplace

Launching later in 2025

Transforming Impact Outcomes Financing with Web3

At ImpactScope our thesis is that the coming decade will witness a major shift in how impact outcomes are funded, created and verified. We believe that the confluence of Distributed Ledger Technology, Web3 building blocks and Artificial Intelligence will spawn new models for financing and verifying impact outcomes.

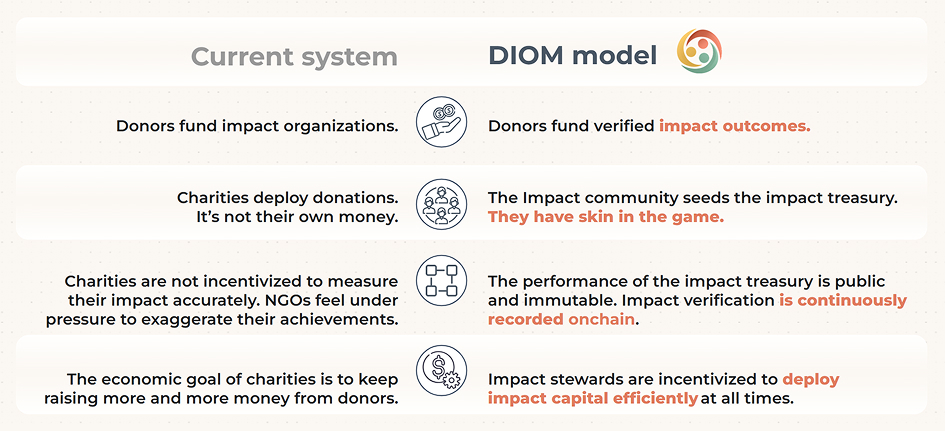

The way that charities and NGOs raise and deploy capital is ineffective and often opaque.

According to Charity Navigator even the top performing charities in the world spend upwards of 20 % of their annual budgets on fundraising costs. Another 20 % is spent on admin overheads. In the current system charities and NGOs often become inefficient intermediaries between donors and impact creators. Meanwhile donors (governments, foundations, CSR programs) end up financing processes and organizations instead of funding pre-agreed impact outcomes and verified results.

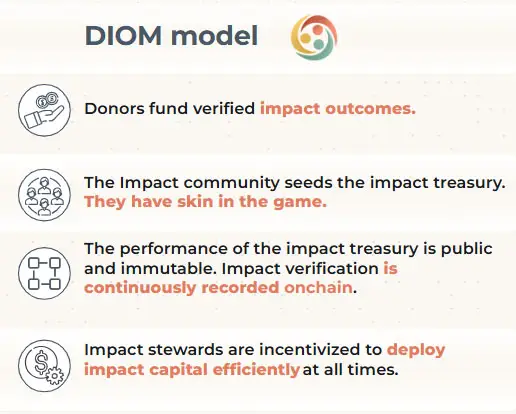

How does DIOM do things differently?

With DIOM we are changing the way impact outcomes are financed and verified.

DIOM replaces the concept of multiple centralized charities with one decentralized funding pool. Donors, known as “Impact Outcome Commissioners” on DIOM, define the parameters of the impact outcomes they wish to create, as well as the “reward” which is paid out as soon as the outcome is delivered and independently verified. On DIOM this reward is known as the Impact Bounty.